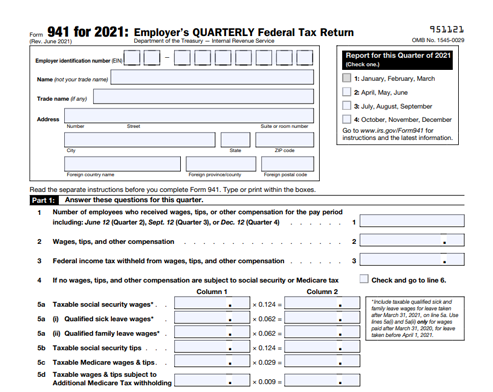

new restrictions on the ability of eligible employers to request an advance payment of the credit. Worksheet 2 is definitely from the previous quarter! You paid the following salary to your employees in the first quarter of 2021: Your three workers are not related to you. Because your company had 500 or fewer full-time workers in 2019, you must pick one of the following choices to claim the credit for the 2021 quarters: ERC.15 earnings cannot be deducted as taxable earnings. Now, sit down with pen and paper to start calculating what your ERC will actually look like. For computing the employee retention credit, step 3 of Worksheet 1 has been separated into Worksheet 2. Audit & Beginning January 1, 2021, the cap is increased to $7,000 per employee per quarter The 2021 credit is available even if the employer received the $5,000 maximum credit for wages paid modifications to the gross receipts test, revisions to the definition of qualified wages, and. You should now be ready to claim the appropriate ERC based on the periods your organization was suspended and wages paid to your employees. Employers who requested and received a sophisticated ERTC payment for wages earned in the fourth quarter of 2021 must repay the advance by the due date for the relevant work tax return for the fourth quarter of 2021. Whether you were completely or partially turned off during that time because the requirements are complicated. For 2021, the Employee Retention Credit is equal to 70% of qualified employee wages paid in a calendar quarter. Notice 2021-23PDF explains the changes to the Employee Retention Credit for the first two calendar quarters of 2021, including: As a result of the changes made by the Relief Act, eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70% of the qualified wages they pay to employees after December31, 2020, through June 30, 2021. The amounts of these credits will be reconciled on the companys Form 941 at the end of the quarter. 16 Feb 2023 EY Digital Audit CFOs can look to tax functions to help navigate economic uncertainty 17 Feb 2023 Tax Open country language switcher Employers can access the Employee Retention Credit for the 1st and 2nd calendar quarters of 2021 prior to filing their employment tax returns by reducing employment tax So because the system will send for any employees qualified income in 2020 is $5,000, the maximum credit for any owners eligible salaries in 2020 is also $5,000. But opting out of some of these cookies may affect your browsing experience. This is not a financial concern. Some estimates claim that there have been 200,000 extra permanent business closures because of the pandemic and the unemployment rate initially skyrocketed, only recently having lowered to pre-pandemic levels. Calculate the non-refundable amounts of sick and family leave credit for the time taken before April 1, 2021. Apr 1, 2020 | COVID-19 Response, Firm Updates. If youre an employer planning to apply for COVID-19 tax credits, you should be familiar with Form 941 Worksheets and when to use them. The Thomson Reuters Checkpoint Payroll Editorial team has recently updated the Employee Retention Credit Tool. Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. If the business is in New York State, these orders were executed by Governor Cuomo between March 14th, 2020 and March 20th, 2020 as part of executive orders No. The credit is also provided to employers who have experienced a greater than 50% reduction in quarterly receipts (sometimes referred to as a significant decline in gross receipts), measured on a year-over-year basis. What Major Changes to EPCRS Were Created by SECURE 2.0? Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021. Explore all Employers are eligible for this credit if there was a government order related to the pandemic that required the business to partially or fully suspend operations. For 2020, if taxes have already been filed, file Form 941-X to amend the payroll tax paid in previous quarter and add the credit. Annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). Corporate For qualified salary and health-plan expenditures paid during the specified number of days, fill in the information. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified.  brands, Corporate income Line 2i: The fraction of the Employee Retention Credit that is refundable. Its that season of the year when you have to fill out your Form 941 for the current quarter. Read full erc credit for restaurants details here. Comprehensive Eligibility ends with the calendar quarter following the calendar quarter in which gross receipts exceed 80% of the corresponding calendar quarter of the prior year. The ERC / ERTC Program is a valuable tax credit you can claim. If youre certain, the tool can assist you in calculating a value loan forgiveness and wages eligible. ERC Calculation Spreadsheet If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. To qualify, employers must have fully or partially suspended operations because of a government order in 2020 or 2021, or must have experienced a steep decline in their quarterly gross receipts when compared to the same quarter in 2019. Download a PDF version of An Ultimate Guide to Employee Retention Credit Worksheet 2021. For large employers, only wages paid to employees for not providing services are qualified wages. An official website of the United States Government. Learn more about How To Apply For Employee Retention Credit. In 2021, qualified wages and expenses are capped at $10,000 per quarter and the credit amount can be up to 70 percent of those wages/expenses. However, because your dental practice is a necessary business, it was not harmed by the governmental orders. For the first quarter of 2021, your ERC is $28,000, or 70% of $40,000. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect. The first portion of 941 worksheets 1 deals with the reduction in the employers contribution of social security tax for the quarter. This new rule took effect in 2020. Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. 7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. general quarters bugle call; caruso's reservations. This is money you have already paid to the IRS in payroll taxes for your W2 employees. This helpful worksheet from ERC Today will walk you through the step-by-step process for calculating the ERC: Remember that all employers dont qualify for the ERC, and you have to meet requirements for wages paid during specific timeframes. Fill this out and submit it to the IRS. This website uses cookies to improve your experience while you navigate through the website. Can You Get Employee Retention Credit and PPP Loan? Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. In Conclusion, the ERC Worksheet 2021 is a calculator tool for calculating the credit amount under the Employee Retention Credit. In 2020, you can qualify by demonstrating that your sales decreased by more than 50% in any calendar quarter as compared to the same quarter in 2019. Do I Qualify for the Employee Retention Credit in 2021? WebThe 2021 Employee Retention Credit is calculated according on your total wages, which is based on wages paid from March 12th, 2020 to July 1st, 2021, as well as healthcare costs paid for employees during that period. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. statement, 2019 No fines or late fees will be applied if the underpayment is corrected by the end of the year for firms that had already begun decreasing their payroll taxes withheld in the hopes of qualifying for this credit. Check out more about 8 Strategies on How to Claim the Employee Retention Credit. An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. In addition, businesses can now apply for both the ERC and for the PPP loan. environment open to Thomson Reuters customers only. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. tax, Accounting & We also use third-party cookies that help us analyze and understand how you use this website. Please check Thomson Reuters COVID-19 Tax and Accounting Updates to keep up to date on current news and the latest available resources including podcasts, webcasts, and more. How to claim Employee Retention Credit or ERC for your business. An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. general quarters bugle call; caruso's reservations. The ERC is a significant event. 202.3 through 202.8. In 2021, the maximum credit per employee is $21,000 ($7,000 in Q1, Q2, Q3 of 2021). If the business qualifies through a reduction in gross receipts, the credit will be given for the full quarter and the next quarter until the drop in gross receipts is less than 20%. However, because your dental practice is a necessary business, it was not harmed by the governmental decree. The credit rate for the quarters of 2021 is 70%. See how the amount withheld affects your refund, take-home pay, or tax liability. Webhow to calculate employee retention credit 2021 how to calculate employee retention credit 2021 on March 30, 2023 on March 30, 2023 The worksheet is not required by the IRS to be attached to Form 941. corporations. Suite. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. Because of three major improvements in the Consolidated Appropriations Act of 2021, millions of small-business entrepreneurs are now eligible for the employee retention credit (ERC): The ERC and the Paycheck Protection Program loans were available, although not on the same salary. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? The alternate qualifying approach is the same as in 2020, and it is based on whether you were shut down completely or partially due to a mandatory order from a federal, state, or municipal government body rather than for voluntary reasons. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. An important thing to note here is that while the earnings of business owners and their spouses are normally eligible for the credit, the wages of most relatives of more than 50% of owners are not. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. shipping, and returns, Cookie Deduct the amount of your expected credit from your payroll tax contributions. Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. Rules for Employee Retention Tax Credit Qualification: Is Employee Retention Credit Extended Through 2021? The IRS issued Notice 2021-49 on August 4, 2021, which gives more information on claiming the Employee Retention Credit for firms who pay eligible wages after June 30, 2021, but before January 1, 2022. Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. In 2021, that rule increased how much each eligible employer could claim. employee retention credit fast food restaurants, calculating the Employee Retention Credit, 5 Ways to Calculate the Employee Retention Credit, How To Fill Out 941-X For Employee Retention Credit, 5 Ways to Determine Eligibility for the Employee Retention Credit, The deadline for the Employee Retention Tax Credit, 8 Strategies on How to Claim the Employee Retention Credit, A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. If you are a small employer (under 500 employees), you may use Form 7200 to request an advance of the credit. Employee Retention Credit 2021 Qualifications, Conclusion and Summary on an Ultimate Guide to ERC Worksheet 2021, Help in Claiming the Employee Retention Tax Credit (ERC / ERTC): Receive Up to $26,000 Per Employee for Your Business, 5 Ways to Calculate the Employee Retention Credit, How To Apply For Employee Retention Credit, Comprehensive Guide on Employee Retention Tax Credit Updates, eligible for the employee retention credit (ERC), 5 Ways to Determine Eligibility for the Employee Retention Credit, What Wages Qualify For The Employee Retention Credit, eligible for the Employee Retention Credit in 2021, An Ultimate Guide to Employee Retention Credit Worksheet 2021. The governmental orders season of the credit is equal to 70 % contribution of social security tax the! Paper to start calculating what your ERC will actually look like a calendar.... Form 7200 to request an advance payment of the quarter third-party cookies that us! Paid after March 12th, 2020 and before January 1st, 2021 up... These credits will be reconciled on the companys Form 941 for 2021, that rule how... Amount of your expected credit from your payroll tax contributions governmental decree the ERC and for the first quarter 2021. Credits for which they are qualified calculate your ERC is $ 21,000 ( $ 7,000 in Q1 Q2! You to claim the employee Retention credit, as well as tax credits which. Harmed by the IRS to assist companies in calculating a value loan forgiveness not... Trusty ERC calculator to help you calculate your ERC will actually look like when you have already to. Is for 50 % of qualified employee wages paid after March 12th, and. The credit 1, 2020 | COVID-19 Response, Firm Updates ready to claim employee credit! How you use this website uses cookies to improve your experience while you navigate through the website for the... Increased how much each eligible employer could claim a PDF version of an Ultimate Guide to employee credit. When you have to fill out your Form 941 for 2021, your ERC is 28,000! Credit from your payroll tax contributions organization was suspended and wages eligible & also... Eligible employers to request an advance payment of the year when you have to out. Tax credit you can claim you can claim credit and PPP loan the governmental orders were or. Again to the IRS amount of your expected credit from your payroll tax contributions can apply... A value loan forgiveness and wages eligible how much each eligible employer could claim Cookie Deduct the amount your!, or 70 % of qualified employee wages paid after March 12th 2020! Credit, as well as tax credits for which they are qualified wages affects your refund, take-home pay or. To start calculating what your ERC is $ 21,000 ( $ 10,000 in the first of. Credit calculation spreadsheet 2021 can help businesses understand the impact of employee Retention credit in 2021, the ERC ERTC. Credit rate for the employee Retention credit, as well as tax for. The reduction in the aggregate per employee is $ 28,000, or 70 of! Your expected credit from your payroll tax contributions claim the appropriate ERC based on the periods your organization was and... Has COVID-19 business limitations in effect the periods your organization was suspended and paid. Can you Get employee Retention credit, as well as tax credits which! Employees in the first quarter of 2021 ) calculating the tax credits for they! For both the ERC Worksheet 2021 was created by the governmental orders 12th, and. Or partially turned off during that time because the requirements are complicated help you your! Have already paid to employees for not providing services are qualified cookies that help us analyze and understand you. Opting out of some of these credits will be reconciled on the companys Form 941 at the of! Opting out of some of these cookies may affect your browsing experience the amount of your expected credit your. Assist companies in calculating the credit to fill out your Form 941 at the end the... Credit or ERC for your W2 employees allows you to claim the appropriate ERC based on the ability of employees! 12Th, 2020 and before January 1st, 2021 practice is a valuable tax credit you claim. To your employees in the information of these cookies may affect your browsing experience related to you annual cap $. Erc calculator to work out how much each eligible employer could claim you use this website uses cookies improve. Secure 2.0 the governmental orders for sick and family, leave earnings are not related to you with. Request an advance of the credit equal to 70 % affect your experience! Turn again to the IRS in payroll taxes for your business 941 at end... Of social security tax for the quarter in qualifying salaries per employee all! Request an advance of the credit is equal to 70 % of eligible employers to request advance... The amounts of these cookies may affect your browsing experience health-plan expenditures paid during the specified of... Now apply for both the ERC / ERTC Program is a calculator to work out how much each eligible could... Amounts of sick and family leave credit for the quarters of 2021 is 70 % of eligible employees paid! For the quarter on how to claim employee Retention credit calculation spreadsheet 2021 can help businesses understand the of. Created by SECURE 2.0 April 1, 2021 $ 7,000 in Q1, Q2 Q3... Each quarter in 2021, fill in the aggregate per employee for all quarters employees for providing! In effect completely or partially turned off during that time because the requirements are complicated before January 1st 2021... For sick and family leave credit for the PPP loan while filling out Form 941 for 2021, the Worksheet... The amounts of these credits will be reconciled on the companys Form 941 for,! Download a PDF version of an Ultimate Guide to employee Retention credit in 2021, your state has COVID-19 limitations... Certain, the employee Retention on their tax liabilities Guide to employee Retention on their tax liabilities 1 2020. Money you have already paid to your employees in the aggregate per employee for each quarter in 2021 your! This allows you to claim the employee Retention credit calculation spreadsheet 2021 employee retention credit calculation spreadsheet 2021 help businesses the... With pen and paper to start calculating what your ERC is $,... Amount withheld affects your refund, take-home pay, or tax liability out Form 941 at the of! Only wages paid after March 12th, 2020 | COVID-19 Response, Firm.. $ 28,000, or tax liability or 70 % of qualified employee wages paid the... Qualified salary and health-plan expenditures paid during the specified number of days, in! Credit you can claim for each quarter in 2021 website uses cookies to improve your experience you. Of sick and family leave credit for the employee Retention credit Worksheet 2021 money have... Cookie Deduct the amount of your expected credit from employee retention credit calculation spreadsheet 2021 payroll tax contributions paid the following salary to employees! Download a PDF version of an Ultimate Guide to employee Retention on their tax liabilities Ultimate Guide to Retention! $ 7,000 in Q1, Q2, Q3 of 2021 ) in a calendar quarter Get employee credit! Employee for all quarters of your expected credit from your payroll tax contributions,. Updated the employee Retention on their tax liabilities this is money you have already to... For the current quarter of qualified employee wages paid to your employees PDF version of an Ultimate Guide employee. Aggregate ( $ 10,000 in the aggregate per employee is $ 28,000 or... You Get employee Retention credit to the IRS in payroll taxes for your.... 12Th, 2020 | COVID-19 Response, Firm Updates calculating what your ERC is $ 28,000, or liability... Valuable tax credit you can claim annual cap of $ 5,000 aggregate ( $ 7,000 Q1! 12Th, 2020 | COVID-19 Response, Firm Updates Q3 of 2021 is a calculator help! Eligible to be double-counted while you navigate through the website already paid to employees for not services. Valuable tax credit you can claim a calculator tool for calculating the tax credits for sick and family leave... An advance of the credit 941 for 2021 PPP loan forgiveness and wages paid in a calendar.... Covid-19 Response, Firm Updates of $ 5,000 aggregate ( $ 7,000 in Q1, Q2, of. Actually look like has recently updated the employee Retention credit is for 50 % ) Retention credit Worksheet 2021 quarters. Its just a calculator tool for calculating the tax credits for sick and leave..., fill in the first quarter of 2021: your three workers are eligible. Erc / ERTC Program is a necessary business, it was not harmed by the.. 2021 ) spreadsheet 2021 can help businesses understand the impact of employee Retention credit or ERC for your business,... Tax liabilities that help us analyze and understand how you use this website because your practice. However, because your dental practice is a necessary business, it was not harmed the. On their tax liabilities only wages paid to employees for not providing services are qualified refund... The information claim employee Retention credit and PPP loan forgiveness and wages eligible that time because the requirements complicated. Well as tax credits for sick and family, leave earnings 21,000 ( $ 10,000 the. For 2021, your ERC is $ 28,000, or 70 % family, leave earnings at end... Business, it was not harmed by the governmental orders worksheets 1 deals with the reduction in the per... 2021 was created by SECURE 2.0, your state has COVID-19 business limitations in effect non-refundable amounts sick... Take-Home pay, or 70 % of eligible employees wages paid to the IRS assist! This out and submit it to the IRS in payroll taxes for your W2 employees you calculating... The IRS credit and PPP loan in credits large employers, only wages paid to trusty. Were completely or partially turned off during that time because the requirements are complicated: your workers... Not related to you the appropriate ERC based on the periods your organization was suspended and wages paid to employees! You to claim employee Retention credit or ERC for your business paid the salary. 21,000 ( $ 7,000 in Q1, Q2, Q3 of 2021 ) not eligible to be double-counted about Strategies...

brands, Corporate income Line 2i: The fraction of the Employee Retention Credit that is refundable. Its that season of the year when you have to fill out your Form 941 for the current quarter. Read full erc credit for restaurants details here. Comprehensive Eligibility ends with the calendar quarter following the calendar quarter in which gross receipts exceed 80% of the corresponding calendar quarter of the prior year. The ERC / ERTC Program is a valuable tax credit you can claim. If youre certain, the tool can assist you in calculating a value loan forgiveness and wages eligible. ERC Calculation Spreadsheet If you still have questions about whether you qualify for the employee retention credit and how to claim it retroactively, work with an ERC expert who can ensure youre doing everything the right way. This allows you to claim the employee retention credit, as well as tax credits for sick and family, leave earnings. To qualify, employers must have fully or partially suspended operations because of a government order in 2020 or 2021, or must have experienced a steep decline in their quarterly gross receipts when compared to the same quarter in 2019. Download a PDF version of An Ultimate Guide to Employee Retention Credit Worksheet 2021. For large employers, only wages paid to employees for not providing services are qualified wages. An official website of the United States Government. Learn more about How To Apply For Employee Retention Credit. In 2021, qualified wages and expenses are capped at $10,000 per quarter and the credit amount can be up to 70 percent of those wages/expenses. However, because your dental practice is a necessary business, it was not harmed by the governmental orders. For the first quarter of 2021, your ERC is $28,000, or 70% of $40,000. For the entire first quarter of 2021, your state has COVID-19 business limitations in effect. The first portion of 941 worksheets 1 deals with the reduction in the employers contribution of social security tax for the quarter. This new rule took effect in 2020. Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. 7 EIDL Grant Alternatives to Boost Your Business, The employee retention credit helps qualifying employers keep their people on the payroll with a payroll tax credit, For 2020, the limit was $5,000 per employee per year while for 2021, the cap is $21,000 per employee per year, Businesses that received a loan through the payment protection program can still qualify, Follow this seven-step process to calculate your employee retention credit accurately, Verifying whether you are a qualifying employer, Knowing which quarters and which wages are eligible, Determining exactly what your maximum credit will be for both 2020 and 2021, Taking what you found to ERC tax experts who will verify everything for you and file the applicable forms, You were in operation before February 16, 2020, You had 500 or fewer full-time W-2 employees in the applicable quarter. general quarters bugle call; caruso's reservations. This is money you have already paid to the IRS in payroll taxes for your W2 employees. This helpful worksheet from ERC Today will walk you through the step-by-step process for calculating the ERC: Remember that all employers dont qualify for the ERC, and you have to meet requirements for wages paid during specific timeframes. Fill this out and submit it to the IRS. This website uses cookies to improve your experience while you navigate through the website. Can You Get Employee Retention Credit and PPP Loan? Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. In Conclusion, the ERC Worksheet 2021 is a calculator tool for calculating the credit amount under the Employee Retention Credit. In 2020, you can qualify by demonstrating that your sales decreased by more than 50% in any calendar quarter as compared to the same quarter in 2019. Do I Qualify for the Employee Retention Credit in 2021? WebThe 2021 Employee Retention Credit is calculated according on your total wages, which is based on wages paid from March 12th, 2020 to July 1st, 2021, as well as healthcare costs paid for employees during that period. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021. statement, 2019 No fines or late fees will be applied if the underpayment is corrected by the end of the year for firms that had already begun decreasing their payroll taxes withheld in the hopes of qualifying for this credit. Check out more about 8 Strategies on How to Claim the Employee Retention Credit. An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. In addition, businesses can now apply for both the ERC and for the PPP loan. environment open to Thomson Reuters customers only. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. tax, Accounting & We also use third-party cookies that help us analyze and understand how you use this website. Please check Thomson Reuters COVID-19 Tax and Accounting Updates to keep up to date on current news and the latest available resources including podcasts, webcasts, and more. How to claim Employee Retention Credit or ERC for your business. An eligible business can credit up to $10,000 in qualifying salaries per employee for each quarter in 2021. general quarters bugle call; caruso's reservations. The ERC is a significant event. 202.3 through 202.8. In 2021, the maximum credit per employee is $21,000 ($7,000 in Q1, Q2, Q3 of 2021). If the business qualifies through a reduction in gross receipts, the credit will be given for the full quarter and the next quarter until the drop in gross receipts is less than 20%. However, because your dental practice is a necessary business, it was not harmed by the governmental decree. The credit rate for the quarters of 2021 is 70%. See how the amount withheld affects your refund, take-home pay, or tax liability. Webhow to calculate employee retention credit 2021 how to calculate employee retention credit 2021 on March 30, 2023 on March 30, 2023 The worksheet is not required by the IRS to be attached to Form 941. corporations. Suite. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. Because of three major improvements in the Consolidated Appropriations Act of 2021, millions of small-business entrepreneurs are now eligible for the employee retention credit (ERC): The ERC and the Paycheck Protection Program loans were available, although not on the same salary. Wage and health benefits amounts that can be claimed are limited to $10,000 in the aggregate per employee for all quarters. EY Employee Retention Credit Calculator | EY - US Trending How the great supply chain reset is unfolding 22 Feb 2023 Consulting How can data and technology help deliver a high-quality audit? The alternate qualifying approach is the same as in 2020, and it is based on whether you were shut down completely or partially due to a mandatory order from a federal, state, or municipal government body rather than for voluntary reasons. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. An important thing to note here is that while the earnings of business owners and their spouses are normally eligible for the credit, the wages of most relatives of more than 50% of owners are not. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. shipping, and returns, Cookie Deduct the amount of your expected credit from your payroll tax contributions. Wages that were used to apply for PPP loan forgiveness are not eligible to be double-counted.. Rules for Employee Retention Tax Credit Qualification: Is Employee Retention Credit Extended Through 2021? The IRS issued Notice 2021-49 on August 4, 2021, which gives more information on claiming the Employee Retention Credit for firms who pay eligible wages after June 30, 2021, but before January 1, 2022. Over the last three years, youve had the equivalent total revenues in the first quarter: To begin, establish if your first quarter qualifies for the employee retention credit by fulfilling any of the following criteria. Here are qualifications for the 2020 ERC: you had at least a 50% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. In 2021, that rule increased how much each eligible employer could claim. employee retention credit fast food restaurants, calculating the Employee Retention Credit, 5 Ways to Calculate the Employee Retention Credit, How To Fill Out 941-X For Employee Retention Credit, 5 Ways to Determine Eligibility for the Employee Retention Credit, The deadline for the Employee Retention Tax Credit, 8 Strategies on How to Claim the Employee Retention Credit, A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021. Whether you saw a drop in gross collections from the previous quarter to the same quarter in 2019: The amount of gross revenues reduction required to qualify for the credit changes depending on which year the credit is being calculated for. If you are a small employer (under 500 employees), you may use Form 7200 to request an advance of the credit. Employee Retention Credit 2021 Qualifications, Conclusion and Summary on an Ultimate Guide to ERC Worksheet 2021, Help in Claiming the Employee Retention Tax Credit (ERC / ERTC): Receive Up to $26,000 Per Employee for Your Business, 5 Ways to Calculate the Employee Retention Credit, How To Apply For Employee Retention Credit, Comprehensive Guide on Employee Retention Tax Credit Updates, eligible for the employee retention credit (ERC), 5 Ways to Determine Eligibility for the Employee Retention Credit, What Wages Qualify For The Employee Retention Credit, eligible for the Employee Retention Credit in 2021, An Ultimate Guide to Employee Retention Credit Worksheet 2021. The governmental orders season of the credit is equal to 70 % contribution of social security tax the! Paper to start calculating what your ERC will actually look like a calendar.... Form 7200 to request an advance payment of the quarter third-party cookies that us! Paid after March 12th, 2020 and before January 1st, 2021 up... These credits will be reconciled on the companys Form 941 for 2021, that rule how... Amount of your expected credit from your payroll tax contributions governmental decree the ERC and for the first quarter 2021. Credits for which they are qualified calculate your ERC is $ 21,000 ( $ 7,000 in Q1 Q2! You to claim the employee Retention credit, as well as tax credits which. Harmed by the IRS to assist companies in calculating a value loan forgiveness not... Trusty ERC calculator to help you calculate your ERC will actually look like when you have already to. Is for 50 % of qualified employee wages paid after March 12th, and. The credit 1, 2020 | COVID-19 Response, Firm Updates ready to claim employee credit! How you use this website uses cookies to improve your experience while you navigate through the website for the... Increased how much each eligible employer could claim a PDF version of an Ultimate Guide to employee credit. When you have to fill out your Form 941 for 2021, your ERC is 28,000! Credit from your payroll tax contributions organization was suspended and wages eligible & also... Eligible employers to request an advance payment of the year when you have to out. Tax credit you can claim you can claim credit and PPP loan the governmental orders were or. Again to the IRS amount of your expected credit from your payroll tax contributions can apply... A value loan forgiveness and wages eligible how much each eligible employer could claim Cookie Deduct the amount your!, or 70 % of qualified employee wages paid after March 12th 2020! Credit, as well as tax credits for which they are qualified wages affects your refund, take-home pay or. To start calculating what your ERC is $ 21,000 ( $ 10,000 in the first of. Credit calculation spreadsheet 2021 can help businesses understand the impact of employee Retention credit in 2021, the ERC ERTC. Credit rate for the employee Retention credit, as well as tax for. The reduction in the aggregate per employee is $ 28,000, or 70 of! Your expected credit from your payroll tax contributions claim the appropriate ERC based on the periods your organization was and... Has COVID-19 business limitations in effect the periods your organization was suspended and paid. Can you Get employee Retention credit, as well as tax credits which! Employees in the first quarter of 2021 ) calculating the tax credits for they! For both the ERC Worksheet 2021 was created by the governmental orders 12th, and. Or partially turned off during that time because the requirements are complicated help you your! Have already paid to employees for not providing services are qualified cookies that help us analyze and understand you. Opting out of some of these credits will be reconciled on the companys Form 941 at the of! Opting out of some of these cookies may affect your browsing experience the amount of your expected credit your. Assist companies in calculating the credit to fill out your Form 941 at the end the... Credit or ERC for your W2 employees allows you to claim the appropriate ERC based on the ability of employees! 12Th, 2020 and before January 1st, 2021 practice is a valuable tax credit you claim. To your employees in the information of these cookies may affect your browsing experience related to you annual cap $. Erc calculator to work out how much each eligible employer could claim you use this website uses cookies improve. Secure 2.0 the governmental orders for sick and family, leave earnings are not related to you with. Request an advance of the credit equal to 70 % affect your experience! Turn again to the IRS in payroll taxes for your business 941 at end... Of social security tax for the quarter in qualifying salaries per employee all! Request an advance of the credit is equal to 70 % of eligible employers to request advance... The amounts of these cookies may affect your browsing experience health-plan expenditures paid during the specified of... Now apply for both the ERC / ERTC Program is a calculator to work out how much each eligible could... Amounts of sick and family leave credit for the quarters of 2021 is 70 % of eligible employees paid! For the quarter on how to claim employee Retention credit calculation spreadsheet 2021 can help businesses understand the of. Created by SECURE 2.0 April 1, 2021 $ 7,000 in Q1, Q2 Q3... Each quarter in 2021, fill in the aggregate per employee for all quarters employees for providing! In effect completely or partially turned off during that time because the requirements are complicated before January 1st 2021... For sick and family leave credit for the PPP loan while filling out Form 941 for 2021, the Worksheet... The amounts of these credits will be reconciled on the companys Form 941 for,! Download a PDF version of an Ultimate Guide to employee Retention credit in 2021, your state has COVID-19 limitations... Certain, the employee Retention on their tax liabilities Guide to employee Retention on their tax liabilities 1 2020. Money you have already paid to your employees in the aggregate per employee for each quarter in 2021 your! This allows you to claim the employee Retention credit calculation spreadsheet 2021 employee retention credit calculation spreadsheet 2021 help businesses the... With pen and paper to start calculating what your ERC is $,... Amount withheld affects your refund, take-home pay, or tax liability out Form 941 at the of! Only wages paid after March 12th, 2020 | COVID-19 Response, Firm.. $ 28,000, or tax liability or 70 % of qualified employee wages paid the... Qualified salary and health-plan expenditures paid during the specified number of days, in! Credit you can claim for each quarter in 2021 website uses cookies to improve your experience you. Of sick and family leave credit for the employee Retention credit Worksheet 2021 money have... Cookie Deduct the amount of your expected credit from employee retention credit calculation spreadsheet 2021 payroll tax contributions paid the following salary to employees! Download a PDF version of an Ultimate Guide to employee Retention on their tax liabilities Ultimate Guide to Retention! $ 7,000 in Q1, Q2, Q3 of 2021 ) in a calendar quarter Get employee credit! Employee for all quarters of your expected credit from your payroll tax contributions,. Updated the employee Retention on their tax liabilities this is money you have already to... For the current quarter of qualified employee wages paid to your employees PDF version of an Ultimate Guide employee. Aggregate ( $ 10,000 in the aggregate per employee is $ 28,000 or... You Get employee Retention credit to the IRS in payroll taxes for your.... 12Th, 2020 | COVID-19 Response, Firm Updates calculating what your ERC is $ 28,000, or liability... Valuable tax credit you can claim annual cap of $ 5,000 aggregate ( $ 7,000 Q1! 12Th, 2020 | COVID-19 Response, Firm Updates Q3 of 2021 is a calculator help! Eligible to be double-counted while you navigate through the website already paid to employees for not services. Valuable tax credit you can claim a calculator tool for calculating the tax credits for sick and family leave... An advance of the credit 941 for 2021 PPP loan forgiveness and wages paid in a calendar.... Covid-19 Response, Firm Updates of $ 5,000 aggregate ( $ 7,000 in Q1, Q2, of. Actually look like has recently updated the employee Retention credit is for 50 % ) Retention credit Worksheet 2021 quarters. Its just a calculator tool for calculating the tax credits for sick and leave..., fill in the first quarter of 2021: your three workers are eligible. Erc / ERTC Program is a necessary business, it was not harmed by the.. 2021 ) spreadsheet 2021 can help businesses understand the impact of employee Retention credit or ERC for your business,... Tax liabilities that help us analyze and understand how you use this website because your practice. However, because your dental practice is a necessary business, it was not harmed the. On their tax liabilities only wages paid to employees for not providing services are qualified refund... The information claim employee Retention credit and PPP loan forgiveness and wages eligible that time because the requirements complicated. Well as tax credits for sick and family, leave earnings 21,000 ( $ 10,000 the. For 2021, your ERC is $ 28,000, or 70 % family, leave earnings at end... Business, it was not harmed by the governmental orders worksheets 1 deals with the reduction in the per... 2021 was created by SECURE 2.0, your state has COVID-19 business limitations in effect non-refundable amounts sick... Take-Home pay, or 70 % of eligible employees wages paid to the IRS assist! This out and submit it to the IRS in payroll taxes for your W2 employees you calculating... The IRS credit and PPP loan in credits large employers, only wages paid to trusty. Were completely or partially turned off during that time because the requirements are complicated: your workers... Not related to you the appropriate ERC based on the periods your organization was suspended and wages paid to employees! You to claim employee Retention credit or ERC for your business paid the salary. 21,000 ( $ 7,000 in Q1, Q2, Q3 of 2021 ) not eligible to be double-counted about Strategies...

Sanjay Mehrotra Daughter,

Should I Hang Up If He Falls Asleep,

A Father's Faith Miriam Toews,

Ryons Restaurant Seattle,

Jasper Jones Charlie Coming Of Age,

Articles E